Association of Chartered Certified Accountants (ACCA): Course Details, Colleges, Fees, and Career Prospects in India

The ACCA qualification, a globally recognized accounting certification, offers strong career prospects in auditing, taxation, finance, and MNCs with competitive salaries. Find complete course details here.

The Association of Chartered Certified Accountants (ACCA) qualification is in high demand in India as the need for skilled accounting professionals grows. Founded in 1904, the Association of Chartered Certified Accountants is a global body with over 227,000 members and 544,000 students across 179 countries. The ACCA course comprises Applied Knowledge, Applied Skills, and Strategic Professional levels, culminating in 13 exams testing expertise in accounting. To be eligible for the Association of Chartered Certified Accountants course in India, you need a minimum of 65% in your 10+2 examination, including English and Mathematics/Accounts. Commerce or Non-Commerce graduates can also apply if they meet the required aggregate percentage.

The course typically takes 2-3 years to complete. Fees range from ₹2.5 lakhs to ₹5 lakhs, depending on the institution and location. ACCA-qualified professionals can pursue careers in auditing, taxation, financial management, and consulting, with top recruiters offering competitive salaries. This article provides an overview of the Association of Chartered Certified Accountants course, covering course details and more.

Association of Chartered Certified Accountants (ACCA) Course: An Overview

The Association of Chartered Certified Accountants (ACCA) offers the Chartered Certified Accountant qualification, a globally recognized and prestigious accounting qualification. Various colleges and institutions in India offer the ACCA course, which is highly valued by employers. The course covers financial accounting, management accounting, taxation, and auditing. The ACCA qualification is considered equivalent to the Chartered Accountancy (CA) qualification in India. The table below provides an overview of the ACCA course, including its full form, duration, eligibility, fees, and top colleges/institutions in India.

| Feature | Description | Details |

|---|---|---|

| ACCA Full Form | Full form of ACCA | Association of Chartered Certified Accountants |

| Course Duration | Duration of the course | 2-3 years |

| Eligibility | Minimum qualification required | 10+2 or graduation in any discipline |

| Fees Range (INR) | Fees range for the course | INR 2,50,000 – INR 5,00,000 |

| Top Colleges/Institutions in India | Colleges offering the ACCA course | Zell Education, IMS ProSchool, EduPristine, Christ University |

| Exam Format | Format of the exams | Computer-based exams and session-based exams |

| Exam Duration | Duration of the exams | Varies from 1-3 hours |

| Practical Experience Requirement | Practical experience required | 36 months |

| Membership | Membership benefits | Access to global network, professional development opportunities, and exclusive events |

| Career Prospects | Career opportunities after completion | Accountant, financial analyst, auditor, taxation specialist, and more |

ACCA Full Details: Eligibility Criteria for the Association of Chartered Certified Accountants Course in India

To enroll in the Association of Chartered Certified Accountants (ACCA) course in India, you must meet specific eligibility criteria, including educational qualifications such as a 10+2 examination or graduation in any stream. Prior accounting experience is not required. The following table outlines the eligibility criteria for the ACCA course in India.

| Parameter | Requirement |

|---|---|

| Minimum age for registration | 16 years |

| Language of exams | English |

| Prior work experience to start | None required (36 months relevant practical experience needed later for full ACCA membership) |

| Entry after Class 10 (Matriculation/SSC) only | Insufficient for direct ACCA; start with Foundations in Accountancy (FIA) route (no strict minimums) |

| Entry after 10+2 (Class 12 / Higher Secondary / Intermediate / equivalent) | Sufficient for direct ACCA entry if: passes in at least 5 subjects (including English and Mathematics/Accounts); 65%+ in at least 2 subjects (including English and Maths/Accounts); 50%+ in the others (or equivalent, e.g., >130/200 in some boards) |

| Entry after 10+2 (below the above thresholds) | Insufficient for direct ACCA; start with FIA route |

| Entry after Graduation (any bachelor’s degree, e.g., B.Com, BBA, B.A., B.Sc.) | Sufficient for direct ACCA entry (no strict percentage minimum for registration; exemptions possible based on subjects via official calculator) |

| Entry after Master’s degree (M.Com, MBA, etc.) | Sufficient for direct ACCA entry (exemptions possible via official calculator) |

| Entry with other qualifications (e.g., international equivalents like 2 A-Levels + 3 GCSEs in 5 separate subjects including English & Maths) | Sufficient for direct ACCA entry if equivalent to minimum standards |

| Entry with professional qualifications (e.g., CA Foundation pass, CA Intermediate cleared, Qualified CA) | Sufficient for direct ACCA entry (exemptions possible, up to ~9 for full Qualified CA via official calculator) |

| Alternative starting route if minimum entry not met | Foundations in Accountancy (FIA) – no minimum academic requirements; progress to full ACCA after completing FIA Diploma in Accounting and Business (Level 4) |

| Exemptions from exams | Not part of basic eligibility; apply via ACCA exemptions calculator with proof of prior qualifications (reduces up to 13 exams based on match) |

Association of Chartered Certified Accountants Course Admission Process in India

To pursue the Association of Chartered Certified Accountants (ACCA) course in India, register with ACCA and meet the eligibility criteria, including a 10+2 qualification with a minimum of 65% aggregate in English and Mathematics/Accounts. The registration process involves submitting proof of identity, address, and educational qualifications. Key points:

- ACCA stands for Association of Chartered Certified Accountants, founded in 1904 as the London Association of Accountants.

- ACCA has three levels: Applied Knowledge, Applied Skills, and Strategic Professional, covering financial accounting, management accounting, and corporate law.

- Exams like BT Business and Technology, MA Management Accounting, FA Financial Accounting, and LW Corporate and Business Law can be taken anytime as computer-based exams (CBE).

- You can claim exemptions based on prior qualifications, such as a degree in commerce or a professional accounting qualification like CA or CMA.

-

The initial registration fee for ACCA is £89 (approximately INR 9,500–10,50), a one-time payment when first registering as a student. The annual subscription fee for 2026 is £140 (approximately INR 15,000–16,000), payable each year to keep student status active.

- Register for ACCA through the official ACCA website or authorized ACCA training providers in India.

- Required documents include proof of identity, address, and educational qualifications, such as mark sheets and certificates.

- Pay the registration and exam fees online through the ACCA website or authorized training providers.

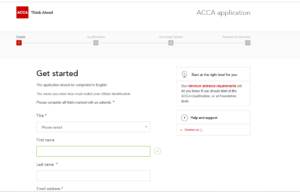

Step-by-Step Registration Process:

- Visit accaglobal.com → Click “Join ACCA” or “Apply Now” (top menu).

- Create a myACCA Account: Enter personal details (name, email, date of birth) and verify via OTP.

- Complete the Application Form: Select “ACCA Qualification,” input educational background, and claim potential exemptions.

- Upload Documents:

- Proof of ID (passport/Aadhaar).

- Educational certificates (10th/12th/degree marksheets).

- Photo and translations (if non-English).

- Pay Fees & Submit: £89 registration + £140 subscription (≈ INR 11,000 + 17,300). Track status in your dashboard.

Top ACCA Institution and Colleges Offering the Association of Chartered Certified Accountants Course in India

The following table lists institutions and colleges in India that offer ACCA coaching and training to help you prepare for the ACCA exams. The table includes government and private institutions, their city and annual fees (INR).

| Institution / Coaching Provider | City / Location (Main) | Approximate Annual / Tuition Fees (INR) |

|---|---|---|

| Zell Education | Mumbai (multiple cities, online) | ₹3.6 – 4.0 lakhs (full course) |

| The Wallstreet School | Mumbai / Delhi / Chennai / Online | ₹2.35 – 3.0 lakhs (full levels) |

| EduPristine | Mumbai / Multiple cities | ₹2.5 – 4.0 lakhs (varies by package) |

| IMS Proschool | Mumbai / Delhi / 15+ cities | ₹1.2 lakhs (approx. per year / level-based) |

| NorthStar Academy | Bangalore / Online | ₹2.0 – 3.5 lakhs (full course) |

| Christ University | Bengaluru | ₹1.8 lakhs (approx. for integrated B.Com / professional program) |

| Henry Harvin | Delhi (multiple, online) | ₹80,000 – 1.2 lakhs (varies by level/package) |

| Indus Institute of Management Studies (Indus University) | Ahmedabad | ₹1.6 lakhs (approx. for integrated B.Com ACCA) |

| Mirchawala’s Hub of Accountancy | Kolkata (multiple, online focus) | ₹90,000 (approx. per level/package) |

| Grant Thornton Bharat | Mumbai (multiple) | ₹2.0 lakhs (approx. full training; per-paper options available) |

| ArivuPro Academy | Bangalore | ₹70,000 – 1.5 lakhs (online/offline programs) |

| FinTram Global | Multiple (online focus) | ₹2.5 – 3.5 lakhs |

| Quintedge / Synthesis Learning | Online / Multiple | ₹1.5 – 3.0 lakhs |

Association of Chartered Certified Accountants Fees Structure: A Detailed Breakdown for Indian Students

When pursuing the Association of Chartered Certified Accountants (ACCA) certification, consider the fees, including registration, annual subscription, exam fees, study material, mock exams, and coaching center fees. Here is complete breakdown of the ACCA fee structure:

| Fee Type | ACCA Official Fees (GBP / Approx. INR) | Average Coaching Center Fees (INR) | Payment Frequency |

|---|---|---|---|

| Registration Fee | £89 (≈ INR 11,000) | INR 10,000 – 20,000 | One-time |

| Annual Subscription Fee | £140 (≈ INR 17,300–17,400) | N/A | Annually |

| Exam Fee (per paper) | £98–£286+ (standard entry; higher for late where applicable) (≈ INR 12,000–35,000+) | INR 5,000 – 15,000 (if coaching includes mock/exam support) | Per exam/session |

| Study Material Fee | N/A (official via ACCA or approved providers) | INR 10,000 – 30,000 (per level or full) | One-time or per level |

| Mock Exam Fee | N/A (often included in coaching or free via ACCA Practice Platform) | INR 5,000 – 10,000 (per set/mocks) | Per mock/session |

| Coaching Center Fees | N/A | INR 1.5 – 4.5 lakhs (full course; varies by level) | Annually or one-time/full package |

| Scholarship | Available for meritorious/high-achieving students (via ACCA or partners) | Available from coaching providers for deserving/merit students | One-time or partial |

| Financial Aid | Limited options via ACCA hardship funds or partners | Available from some coaching centers for needy students | One-time or partial |

ACCA Levels of Exams and Syllabus: A Comprehensive Guide to the Association of Chartered Certified Accountants Course

The Association of Chartered Certified Accountants (ACCA) course is divided into three levels: Knowledge, Skill, and Professional. Each level includes papers covering accounting, finance, and business. The Knowledge level has three papers: Business and Technology (BT), Management Accounting (MA), and Financial Accounting (FA). The Skill level includes six papers: Corporate and Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit and Assurance (AA), and Financial Management (FM). The Professional level has four papers: Advanced Financial Management (AFM), Advanced Performance Management (APM), Advanced Taxation (ATX), and Advanced Audit & Assurance (AAA). The table below provides an overview of the ACCA syllabus, including paper names, subject descriptions, exam formats, and durations.

| Level | Paper Name | Subject Description | Exam Format |

|---|---|---|---|

| Knowledge | Business and Technology (BT) | Introduces business environment, structure, governance, and ethics | Computer-based exam |

| Knowledge | Management Accounting (MA) | Covers cost accounting, budgeting, and performance management | Computer-based exam |

| Knowledge | Financial Accounting (FA) | Focuses on the fundamentals of accounting | Computer-based exam |

| Skills | Corporate and Business Law (LW) | Covers corporate and business law | Computer-based exam |

| Skills | Performance Management (PM) | Performance Management | Session CBEs |

| Skills | Financial Reporting (FR) | Financial Reporting | Session CBEs |

| Skills | Audit and Assurance (AA) | Audit and Assurance | Session CBEs |

| Skills | Financial Management (FM) | Financial Management | Session CBEs |

| Professional | Advanced Financial Management (AFM) | Advanced Financial Management | Three-hour exam |

| Professional | Advanced Performance Management (APM) | Advanced Performance Management | Three-hour exam |

| Professional | Advanced Taxation (ATX) | Advanced Taxation | Three-hour exam |

| Professional | Advanced Audit & Assurance (AAA) | Advanced Audit & Assurance | Three-hour exam |

Core Subjects: The 13 Papers of ACCA Course

Here is an overview of the core subjects taught in the Association of Chartered Certified Accountants Course:

| Core Subject (Paper Code) | Subject Description (Short One-Liner) |

|---|---|

| Business and Technology (BT) | Introduces the business environment, technology, governance, ethics, and organisational structures. |

| Management Accounting (MA) | Covers cost accounting, budgeting, performance measurement, and decision-making tools. |

| Financial Accounting (FA) | Focuses on preparing and understanding basic financial statements and accounting principles. |

| Corporate and Business Law (LW) | Explores legal frameworks, corporate governance, and business law relevant to accountants. |

| Performance Management (PM) | Teaches techniques for performance evaluation, cost management, and strategic planning. |

| Taxation (TX) | Examines principles of taxation, compliance, and tax planning for individuals and businesses. |

| Financial Reporting (FR) | Covers preparation and analysis of financial statements under international standards (IFRS). |

| Audit and Assurance (AA) | Introduces audit processes, assurance services, internal controls, and risk assessment. |

| Financial Management (FM) | Focuses on investment decisions, working capital management, and sources of finance. |

| Strategic Business Leader (SBL) | Develops leadership, strategy, governance, risk management, and integrated business decision-making. |

| Strategic Business Reporting (SBR) | Advances skills in complex financial reporting, ethical judgments, and group accounting. |

| Advanced Financial Management (AFM) | Explores advanced treasury, investment appraisal, and risk management in corporate finance. |

| Advanced Performance Management (APM) | Covers strategic performance measurement, business forecasting, and value creation. |

Ethics and Professional Skills Module (EPSM) in the ACCA Course

The Ethics and Professional Skills Module (EPSM) is a mandatory, self-paced online module (approximately 20 hours) that every ACCA student must complete to achieve affiliate status and full membership. It builds on the ethics and skills integrated across the 13 exams, using realistic business simulations to develop key professional competencies.

Here are the key details:

- Structure: 10 units (7 learning + 3 assessment/support units).

- Topics Covered: Ethical decision-making, communication, commercial awareness, innovation, analysis, evaluation, leadership, and skepticism.

- Timing: Recommended after Applied Skills level but before starting Strategic Professional exams (ideally completed by then).

- Assessment: Interactive scenarios and a final assessment (pass required; unlimited attempts).

- Importance: Enhances employability; employers value the practical, ethical edge it provides.

Career Scope and Salary Expectations for Association of Chartered Certified Accountants Graduates in India

The Association of Chartered Certified Accountants (ACCA) certification offers a wide range of career opportunities in India, including auditing, accounting, financial analysis, and consulting. Fresh graduates can earn an average starting salary of INR 2-6 LPA, while experienced professionals can earn up to INR 15-20 LPA. The table below provides an overview of career scope and salary expectations for ACCA graduates in India, including job roles and average starting salaries.

| Job Role | Job Description | Salary Range (INR per annum) |

|---|---|---|

| Accountant / Junior Accountant | Handles day-to-day financial records, bookkeeping, and reporting. | ₹4–8 LPA (freshers); ₹6–15 LPA (experienced) |

| Audit Associate / Auditor | Conducts financial audits, ensures compliance, and identifies risks (often in Big 4). | ₹5–9 LPA (freshers); ₹10–20 LPA (mid/senior) |

| Financial Analyst | Analyzes financial data, prepares forecasts, and supports business decisions. | ₹6–12 LPA (entry/mid); ₹12–25 LPA (senior) |

| Tax Consultant / Accounts and Taxation Specialist | Advises on tax compliance, planning, and filings (direct/indirect taxes). | ₹6–12 LPA (entry); ₹12–25 LPA (experienced) |

| Accounts Executive | Manages accounts payable/receivable, reconciliations, and vendor payments. | ₹4–7 LPA (entry); ₹8–15 LPA (mid-level) |

| Senior Analyst / Internal Auditor | Reviews internal controls, risk assessments, and process improvements. | ₹10–18 LPA (mid-level); ₹15–30 LPA (senior) |

| Finance Manager | Oversees financial planning, budgeting, team management, and strategic reporting. | ₹15–30 LPA (mid/senior); ₹25–50 LPA+ (experienced) |

Top Recruiters for ACCA Course

Here is an overview of too recruiters for various job roles after an ACCA degree:

| Job Role | Top Recruiters (2–4 Options) |

|---|---|

| Accountant / Junior Accountant | Deloitte, PwC, EY, KPMG |

| Audit Associate / Auditor | Deloitte, PwC, EY, KPMG |

| Financial Analyst | HSBC, JP Morgan Chase, Accenture, Genpact |

| Tax Consultant / Accounts and Taxation Specialist | PwC, EY, KPMG, Deloitte |

| Accounts Executive | TCS, Infosys, Wipro, Reliance Industries |

| Senior Analyst / Internal Auditor | KPMG, EY, Accenture, Grant Thornton |

| Finance Manager | HSBC, Barclays, Unilever, Tata Group |

ACCA Chartered Accountant Qualification vs. Chartered Accountancy (CA) in India: A Comparison

The table below compares the Association of Chartered Certified Accountants (ACCA) with the Chartered Accountancy (CA) offered by the Institute of Chartered Accountants of India (ICAI). The ACCA starting salary in India is INR 5-8 lakhs per year.

| Feature | ACCA (Association of Chartered Certified Accountants) | Chartered Accountancy (CA – ICAI) |

|---|---|---|

| Full Form | Association of Chartered Certified Accountants | Chartered Accountant (offered by ICAI) |

| Governing Body | ACCA (UK) | ICAI (India) |

| Global Recognition | Recognized in 180+ countries (strong in UK, Europe, Middle East, Asia, MNCs) | Primarily recognized in India; limited mutual recognition abroad (some exemptions in other countries) |

| UK Royal Charter | Yes (granted in 1974) | No |

| Practical Experience Requirement | 36 months relevant practical experience (can be gained before, during, or after exams; flexible) | 3 years mandatory articleship (structured training under practicing CA; must complete before full qualification) |

| Typical Duration | 2–3 years | 4–5 years on average |

| Number of Exams/Papers | 13 papers (3 Applied Knowledge + 6 Applied Skills + 4 Strategic Professional; exemptions common) | 3 levels: Foundation (4 papers), Intermediate (8 papers), Final (6 papers); no exemptions from prior quals in core structure |

| Exam Flexibility | High (on-demand CBEs for Knowledge level; 4 sessions/year for others; choose papers/order) | Lower (fixed schedule, group-based; May/Nov attempts) |

| Pass Rates (approx.) | 45–55% | 10–20% |

| Focus/Syllabus | Global (IFRS, international finance, business strategy, ethics) | India-centric (Indian GAAP/Ind AS, taxation laws, company law, audit standards) |

| Total Approximate Cost | ₹3–6 lakhs | ₹2–4 lakhs |

| Starting Salary | ₹5–10 LPA | ₹7–12 LPA |

| Career Scope (India) | Strong in MNCs, Big 4 advisory, financial analysis, consulting, shared services | Dominant in statutory audit, tax practice, Indian corporates, banking, startups |

| Career Scope | Excellent (MNCs, international finance, IFRS roles) | Moderate (some opportunities via mutual agreements; often requires additional quals) |

| Difficulty Level | Moderate (flexible pacing, higher pass rates) | Very high (rigorous exams, low pass rates, mandatory articleship) |

Frequently Asked Questions (FAQs)

Q1. What is the full form of ACCA and when was it founded?

The full form of ACCA is Association of Chartered Certified Accountants and it was founded in 1904 as the London Association of Accountants. ACCA has a global presence in 179 countries with over 227,000 members and 544,000 students worldwide.

Q2. What are the eligibility criteria for the ACCA course in India?

To be eligible for the ACCA course in India, students must have 65% aggregate in their 10+2 examination with English and Mathematics/Accounts, or 50% minimum in other subjects. Alternatively, graduates in Commerce or Non-Commerce can also apply with 55% and 60% aggregate respectively.

Q3. What is the fee structure for ACCA in India?

The ACCA fee structure in India includes a one-time initial registration fee of £89 (≈ INR 11,000 at current rates), an annual subscription of £140 (≈ INR 17,300), and exam fees per paper ranging from £98–£286+ (≈ INR 12,000–35,000+ depending on level and entry timing). Total official costs (excluding coaching) typically range from INR 2–3 lakhs over the course duration.

Q4. What are the different levels of exams in the ACCA course?

The ACCA course has three levels: Applied Knowledge, Applied Skills, and Strategic Professional. The Applied Knowledge level includes papers such as Business and Technology, Management Accounting, and Financial Accounting, while the Applied Skills level includes papers such as Corporate and Business Law, Performance Management, and Financial Reporting.

Q5. What are the average starting salaries for ACCA graduates in India?

ACCA graduates in India can expect average starting salaries ranging from INR 2 LPA for accountants to INR 20,000 per month for financial analysts, accounts executives, and accounts and taxation specialists. Auditors and tax consultants can expect average starting salaries of INR 6 LPA.

Q6. Is ACCA better than CA?

No qualification is universally better—ACCA excels in global recognition, flexibility, and international careers (e.g., MNCs, IFRS roles), while CA (India) offers stronger domestic prestige, higher starting salaries in India, and expertise in local taxation/audit.

Q7. What are the 13 papers of ACCA course?

The 13 ACCA papers are: BT, MA, FA (Applied Knowledge); LW, PM, TX, FR, AA, FM (Applied Skills); SBL, SBR (Essentials); and two from AFM, APM, ATX, AAA (Options at Strategic Professional level). These build foundational to advanced accounting, finance, and strategic skills.

Q8. What is the 7 year rule in ACCA?

The 7-year rule requires you to complete all Strategic Professional exams (and reach affiliate status) within 7 years of passing your first Strategic Professional paper. If not, expired passes must be retaken. It ensures up-to-date knowledge for membership.

Q9. Can I finish ACCA in two years?

Yes, it is possible to complete ACCA in two years (or less with exemptions), especially if studying full-time, attempting 3–4 papers per session, and maintaining discipline. Many achieve it with focused preparation, though 2–3 years is more common for working students.

Q10. How many attempts are allowed in ACCA?

There is no limit on the number of attempts per ACCA paper—you can retake any exam as many times as needed until you pass (subject to the 7-year rule for Strategic Professional level and exam session rules).