The Master of Business Administration (MBA) in Finance is a postgraduate degree that provides in-depth knowledge in financial management, investment strategies, and economic principles. Tailored for graduates with a bachelor’s degree in any discipline, this program emphasizes analytical skills, risk assessment, and decision-making to address complex financial challenges. It prepares professionals for dynamic roles in banking, corporate finance, and investment sectors, bridging academic theory with practical applications. Amid evolving global markets, MBA Finance graduates are essential in driving financial stability and growth in industries like banking, consulting, and asset management.

An MBA in Finance boosts career opportunities by enabling access to leadership positions, competitive salaries, and involvement in strategic financial planning. The curriculum integrates core business subjects with specialized finance courses, including case studies, simulations, and internships. Institutions often partner with financial firms, ensuring alignment with industry trends. Graduates typically pursue careers as financial analysts, investment bankers, or portfolio managers, with the degree also facilitating advanced certifications like CFA.

The two-year program, structured into four semesters, includes foundational management courses, finance electives, and a capstone project. Admissions are merit-based, primarily through national exams, followed by group discussions and interviews. Scholarships and financial aid support talented candidates. Ultimately, an MBA in Finance is a strategic investment, empowering professionals to navigate financial complexities and contribute to organizational success.

MBA Finance Highlights

The MBA in Finance program stands out for its focus on financial acumen and strategic thinking, ideal for aspiring finance professionals. Spanning two years full-time, it offers a blend of theoretical and practical learning. Entrance exams are key for admissions, selecting candidates with strong analytical abilities. Fees differ by institution, with government colleges being more affordable. Graduates benefit from lucrative career paths with attractive compensation.

Key highlights encompass diverse specializations, industry internships, and modern facilities. The program stresses ethical finance, innovation, and global perspectives. Placements involve renowned firms, boosting employability. Scholarships aid meritorious students. This overview assists in understanding the program’s value for informed choices.

| Particular | Details |

| Duration | 2 years (4 semesters) |

| Eligibility | Bachelor’s degree with minimum 50% aggregate (45% for reserved categories) |

| Entrance Exams | CAT, XAT, MAT, CMAT, GMAT |

| Average Fees (INR) | 2,00,000 – 25,00,000 total |

| Average Salary (LPA) | 10 – 30 |

| Top Job Roles | Financial Analyst, Investment Banker, Finance Manager, Risk Analyst |

| Top Recruiters | JP Morgan, Goldman Sachs, HDFC Bank, Deloitte |

MBA Finance Eligibility

To enroll in an MBA in Finance, applicants must satisfy criteria defined by colleges and exam bodies. A bachelor’s degree in any field from a recognized institution is required. The minimum aggregate is usually 50%, with concessions for reserved groups. Strong performance in national or state entrance exams is vital for top programs. Some schools hold their own assessments for non-qualified candidates.

Equivalent degrees may be considered with approval. Professional experience enhances applications for executive programs but is optional for standard entries. No age restrictions apply, accommodating working individuals. Foreign applicants need equivalence documents. Fulfilling these ensures efficient applications and quality education access.

Strict eligibility upholds standards and equity. Verification occurs during admissions. Candidates should ready themselves to improve selection odds.

| Criteria | Requirement |

| Educational Qualification | Bachelor’s degree in any discipline |

| Minimum Marks | 50% aggregate (45% for SC/ST) |

| Entrance Exam | Valid CAT/XAT score or equivalent |

| Work Experience | Preferred for executive MBA |

| Age Limit | None |

MBA Finance Courses and Specialisations

MBA in Finance encompasses core management courses alongside specialized finance modules, addressing varied interests in the field. Programs deliver advanced insights into financial markets, corporate finance, and risk management, matching industry demands. Common areas include investment banking, financial modeling, and international finance. Each focus area covers essential theories, tools, and applications via projects and analyses.

Selection hinges on prior education and aspirations. Curricula evolve with market trends, preparing graduates for real-world roles. Electives enable personalization. This lists prominent courses with overviews for guidance.

Specializations adapt to economic shifts, opening doors in high-growth areas. Interdisciplinary elements encourage comprehensive thinking and adaptability.

| Specialisation | Description | Duration |

| Corporate Finance | Focuses on financial planning, capital budgeting, and corporate valuation | 2 years |

| Investment Banking | Covers mergers, acquisitions, IPOs, and advisory services | 2 years |

| Financial Markets | Explores stock markets, derivatives, and trading strategies | 2 years |

| Risk Management | Emphasizes risk assessment, insurance, and hedging techniques | 2 years |

| International Finance | Deals with forex, global markets, and cross-border transactions | 2 years |

| Fintech | Integrates technology with finance, including blockchain and digital payments | 2 years |

| Behavioral Finance | Studies psychological influences on financial decisions | 2 years |

| Sustainable Finance | Focuses on ESG investing and green finance | 2 years |

MBA Finance Syllabus

The MBA Finance syllabus is crafted to develop expertise over four semesters in two years. It combines core business subjects, finance specials, case studies, and a project. Year one builds foundations in management and economics; year two advances to specialized finance and strategy. This progression fosters from basics to applied research.

Variations occur by institution, but alignment with industry is key. Updates incorporate fintech and sustainability. Students join simulations and internships for practice. Assessments mix exams, assignments, and presentations. This details a standard syllabus for MBA Finance.

Syllabi support planning and goal alignment. Institutes provide outlines per semester.

MBA Finance First Year Syllabus

Year one establishes basics with management and economic courses. Semester 1 covers fundamentals; Semester 2 introduces finance tools.

MBA Finance Semester 1 Syllabus

Semester 1 focuses on core management. Subjects build business understanding and quantitative skills.

| Category | Subjects/Components | Key Topics/Subsections | Credits |

| Core Subjects | Principles of Management | Planning, organizing, leading, controlling, decision-making | 3 |

| Core Subjects | Managerial Economics | Demand analysis, cost theory, market structures, pricing | 3 |

| Core Subjects | Financial Accounting | Balance sheets, income statements, cash flows, ratios | 3 |

| Core Subjects | Organizational Behavior | Motivation, leadership, group dynamics, culture | 3 |

| Core Subjects | Quantitative Methods | Statistics, probability, regression, optimization | 3 |

| Other | Business Communication | Writing, presentations, negotiations | 2 |

Assessments include exams and cases. Total credits: 17.

MBA Finance Semester 2 Syllabus

Semester 2 advances to functional areas, introducing finance basics.

| Category | Subjects/Components | Key Topics/Subsections | Credits |

| Core Subjects | Corporate Finance | Capital structure, dividend policy, working capital | 3 |

| Core Subjects | Marketing Management | Market research, segmentation, 4Ps, branding | 3 |

| Core Subjects | Operations Management | Supply chain, quality control, process design | 3 |

| Core Subjects | Human Resource Management | Recruitment, performance appraisal, training | 3 |

| Core Subjects | Macroeconomics | GDP, inflation, fiscal/monetary policy | 3 |

| Other | Mini Project | Group analysis on business case | 2 |

Focus on integration. Total credits: 17.

MBA Finance Second Year Syllabus

Year two specializes in finance with advanced courses and projects.

MBA Finance Semester 3 Syllabus

Semester 3 delves into finance specials and electives.

| Category | Subjects/Components | Key Topics/Subsections | Credits |

| Core Subjects | Investment Analysis | Portfolio theory, valuation, securities | 3 |

| Core Subjects | Financial Markets | Stock exchanges, derivatives, bonds | 3 |

| Core Subjects | Risk Management | Hedging, insurance, VaR | 3 |

| Electives | Elective 1 (e.g., Fintech) | Blockchain, digital banking | 3 |

| Labs/Practicals | Financial Modeling Lab | Excel, simulations | 2 |

| Other | Research Methods | Data analysis, proposal writing | 2 |

Project prep. Total credits: 16.

MBA Finance Semester 4 Syllabus

Semester 4 centers on capstone and advanced electives.

| Category | Subjects/Components | Key Topics/Subsections | Credits |

| Core Subjects | Strategic Finance | M&A, corporate strategy | 3 |

| Core Subjects | International Finance | Forex, global risks | 3 |

| Electives | Elective 2 (e.g., Sustainable Finance) | ESG, green bonds | 3 |

| Other | Dissertation/Project | Research, presentation | 6 |

| Other | Internship | Industry experience | 3 |

Culminates in defense. Total credits: 18.

The syllabus prepares for finance careers, adaptable to trends.

MBA Finance Syllabus PDF

Below is the latest semester-wise MBA Finance syllabus in PDF format, which you can download.

MBA Finance vs Other Programmes

MBA Finance is a business-oriented degree emphasizing financial strategy and management, differing from programs like M.Com or MS Finance. It suits those seeking broad business skills with finance focus, leading to roles in banking and consulting. M.Com is more accounting-centric, ideal for commerce backgrounds. MS Finance is technical, fitting quantitative roles.

Compared to M.Com, MBA Finance offers practical business applications; MS Finance delves deeper into analytics. For finance depth with management, MBA is ideal; for pure finance, MS. Each aligns with career paths.

Differences aid program selection. MBA Finance targets managerial finance, M.Com accounting, MS advanced finance. MBA Finance integrates business and finance for leadership. M.Com focuses on commerce theory. MS emphasizes financial modeling.

| Programme | Duration | Focus Area | Eligibility | Career Prospects | Average Fees (INR) | Suitable For |

| MBA Finance | 2 years | Financial management, strategy | Bachelor’s 50% + CAT | Finance Manager, Banker | 2,00,000 – 25,00,000 | Business leaders |

| M.Com | 2 years | Accounting, commerce | B.Com 50% | Accountant, Auditor | 50,000 – 2,00,000 | Commerce specialists |

| MS Finance | 1-2 years | Quantitative finance | Bachelor’s + GRE | Analyst, Quant | 5,00,000 – 15,00,000 | Technical experts |

| MBA General | 2 years | Broad management | Bachelor’s + CAT | Manager, Consultant | 2,00,000 – 25,00,000 | Generalists |

| MFin | 1 year | Advanced finance | Bachelor’s + Entrance | Financial Specialist | 10,00,000 – 20,00,000 | Finance pros |

Table overviews differences. Choice based on goals.

MBA Finance Admission Process

Admission to MBA Finance is competitive, centered on exams like CAT. Qualified applicants join counseling or direct applications. Forms submitted online, deadlines Nov-Dec post-results. Verification and payment follow allotment. Some offer direct for experienced. Process transparent, merit-driven. Exam prep key for top seats.

| Step | Description | Timeline (2026 Cycle) | Required Actions/Documents |

| 1. Entrance Registration | Apply for CAT/XAT | Aug-Sep 2025 | Form, photo, fee |

| 2. Entrance Exam | Take test | Nov 2025 | Admit card, ID |

| 3. Results | Check scores | Jan 2026 | Scorecard |

| 4. Application | Apply to colleges | Jan-Feb 2026 | Form, scores |

| 5. GD/PI | Attend rounds | Feb-Mar 2026 | Call letter |

| 6. Allotment | Receive offer | Apr 2026 | Accept |

| 7. Verification | Submit docs | May 2026 | Marks, certs |

| 8. Confirmation | Join | Jun-Jul 2026 | Orientation |

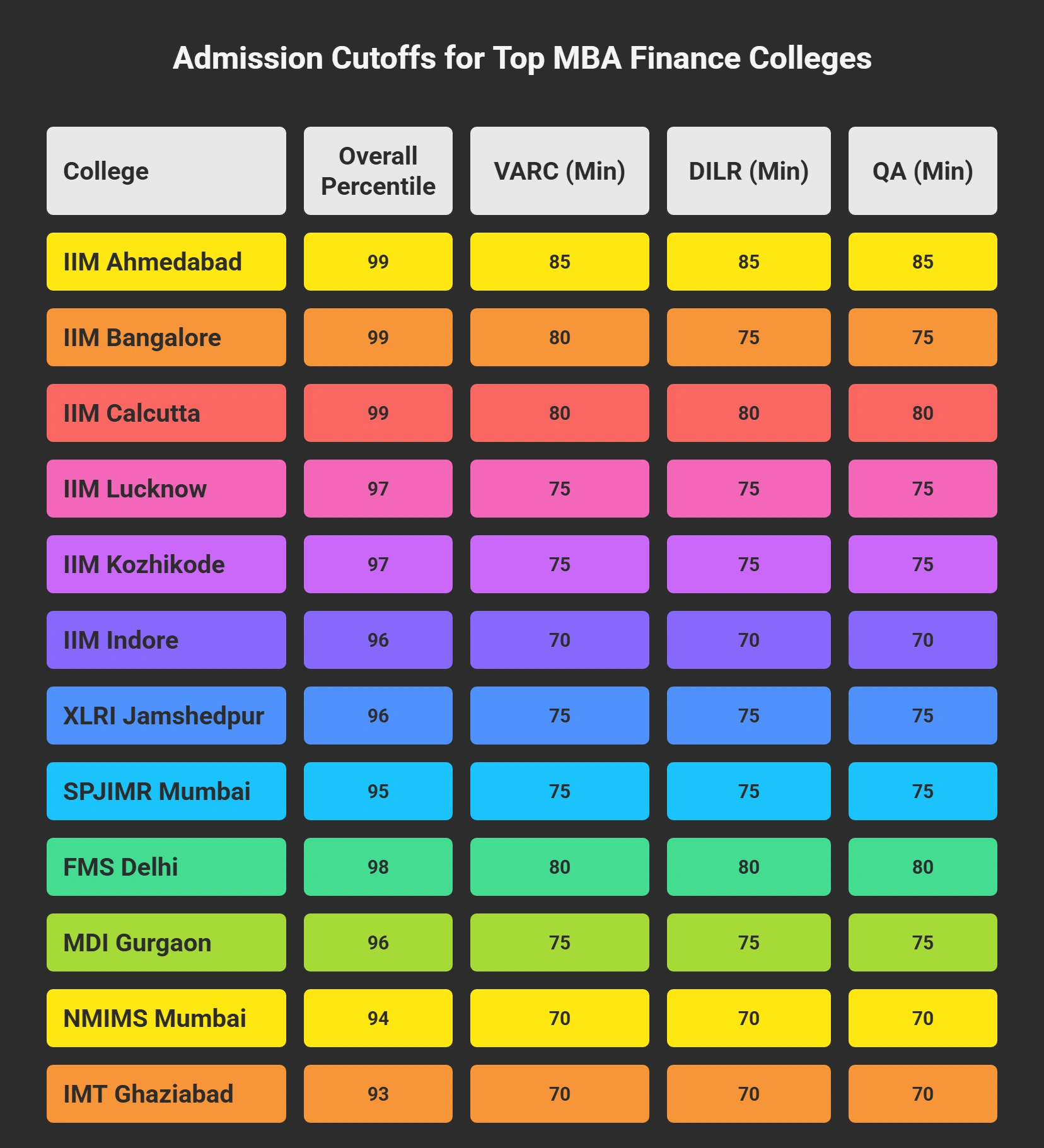

MBA Finance Cut off

Cutoffs are pivotal in MBA Finance admissions, establishing the minimum percentiles required for shortlisting and final selection. There are primarily two types: qualifying cutoffs determined by the exam conducting body like IIMCAT for CAT, which are the baseline scores to be eligible for the exam’s scorecard, and admission cutoffs issued by individual B-schools or through common admission processes.

Qualifying cutoffs are standardized nationwide and differ by exam paper, category, and year, affected by elements such as test difficulty, candidate volume, and score distribution. Admission cutoffs are school-specific and generally higher, indicating the competition for seats in elite programs. These are usually CAT percentiles, not raw scores.

For sought-after specializations like Finance in premier IIMs, admission cutoffs for the General category often surpass 98-99 percentile, with sectional requirements ensuring balanced performance. Reserved categories (NC-OBC, SC/ST, EWS, PwD) receive relaxations, typically 5-10 percentile points lower than General.

Analyzing previous cutoffs assists candidates in setting achievable goals, strategizing preparation, and prioritizing colleges during applications. Cutoffs fluctuate yearly based on seat availability, applicant quality, and policy updates. Aspirants should refer to official sites like iimcat.ac.in for qualifying details and college portals for admission specifics.

Besides CAT, exams like XAT or GMAT have their own cutoffs; for instance, XAT qualifying is around 95 percentile for top schools. Cutoff data post each admission cycle helps refine strategies for subsequent years.

Qualifying Cutoffs

The table below presents expected CAT 2025 qualifying cutoffs (percentiles) for popular categories, derived from recent patterns. These qualify candidates for shortlisting but do not assure admission.

| Category | Overall Percentile | VARC Percentile | DILR Percentile | QA Percentile |

| General/EWS | 90 | 80 | 80 | 80 |

| NC-OBC | 82 | 72 | 72 | 72 |

| SC | 60 | 50 | 50 | 50 |

| ST/PwD | 45 | 40 | 40 | 40 |

Top MBA Finance Colleges Cutoffs

Admission cutoffs vary by institution and program. The table summarizes expected CAT percentiles for the General category in select top IIMs and B-schools for 2025, applicable to 2026 cycles, focusing on MBA Finance or general programs with finance electives. Data sourced from official announcements and may adjust slightly. For reserved categories, cutoffs are generally lower: NC-OBC (85-90% of General), SC/ST (60-70% of General).

These are projected based on 2025 data; actuals may vary. For specialized Finance programs, refer to institute-specific criteria. Higher cutoffs in top IIMs reflect fierce competition, while mid-tier offer broader access.

Top MBA Finance Colleges in India

India’s finance education ecosystem is a curious blend of legacy institutions, high-intensity business hubs, and specialized management schools that treat balance sheets the way astronomers treat star charts—maps of possibility. MBA Finance remains one of the most sought-after management specialisations because it opens doors to investment banking, corporate finance, fintech, consulting, equity research, and risk management. Colleges differ not just in brand value but in the depth of their curriculum, industry immersion, and placement opportunities.

MBA Finance programs across India generally focus on financial modelling, corporate valuation, portfolio theory, derivatives, behavioural finance, global markets, and the strange but thrilling mathematics that keeps the modern economy upright. Below are the leading institutions in both the public and private sector.

Top Government MBA Finance Colleges

Government-run business schools tend to be the quiet powerhouses of management education—strong academic fundamentals, rigorous coursework, and enviable placement networks built over decades.

IIM Ahmedabad, IIM Bangalore and IIM Calcutta routinely grab the limelight for their finance-heavy ecosystems. Calcutta, for instance, has a long history of feeding quant-oriented roles in banks and consultancies. FMS Delhi offers perhaps the country’s best ROI, pairing low fees with elite placements. JBIMS Mumbai has the advantage of living inside India’s financial capital, where investment banks and trading desks are practically neighbours.

| College Name | Total Fees (INR) | Application Deadline (2026 Cycle) | Entrance Exam | Why Apply | Brochure Link | Average Placement Salary (LPA) | NIRF Ranking |

| IIM Ahmedabad | 25,00,000 | Jan 2026 | CAT | Premier institute with global faculty, rigorous curriculum, excellent finance placements. | Download Here | 35 | 1 |

| IIM Bangalore | 25,00,000 | Jan 2026 | CAT | Focus on analytics, strong finance electives, top recruiters. | Download Here | 34 | 2 |

| IIM Calcutta | 27,00,000 | Jan 2026 | CAT | Renowned for finance, consulting placements, alumni network. | Download Here | 35 | 3 |

| IIM Lucknow | 20,00,000 | Jan 2026 | CAT | Balanced curriculum, finance specializations, corporate ties. | Download Here | 30 | 4 |

| IIM Kozhikode | 22,00,000 | Jan 2026 | CAT | Emphasis on sustainable finance, diverse cohort. | Download Here | 28 | 5 |

| IIM Indore | 21,00,000 | Jan 2026 | CAT | Integrated learning, finance labs, placements. | Download Here | 27 | 6 |

| FMS Delhi | 2,00,000 | Jan 2026 | CAT | Affordable, high ROI, strong finance focus. | Download Here | 32 | 8 |

| DMS IIT Delhi | 10,00,000 | Feb 2026 | CAT | Tech-finance blend, research oriented. | Download Here | 25 | 10 |

| IIM Shillong | 20,00,000 | Jan 2026 | CAT | Sustainable practices, northeast focus. | Download Here | 24 | 12 |

| IIM Udaipur | 20,00,000 | Jan 2026 | CAT | Entrepreneurial finance, global exposure. | Download Here | 23 | 15 |

| IIM Trichy | 19,00,000 | Jan 2026 | CAT | Industry-aligned, finance analytics. | Download Here | 22 | 18 |

| IIM Raipur | 16,00,000 | Jan 2026 | CAT | Emerging markets finance. | Download Here | 20 | 20 |

Top Private MBA Finance Colleges

Private institutions bring a different flavour—industry-driven curricula, modern campuses, and strong corporate partnerships. Many of these colleges operate like miniature financial ecosystems, hosting trading labs, Bloomberg terminals, live market simulations, and finance clubs that behave like in-house investment firms.

XLRI sits at the peak of this category with its one-year PGP, drawing global recruiters and mid-career professionals looking for acceleration. SPJIMR Mumbai’s finance specialisation is known for its “value-based leadership” mould, blending quantitative rigor with ethical decision-making. NMIMS Mumbai, with its proximity to Dalal Street, keeps its courses tightly aligned to banking and analytics needs. Symbiosis (SIBM Pune) and TAPMI Manipal also maintain robust links with BFSI, fintech and consulting sectors.

| College Name | Total Fees (INR) | Application Deadline (2026 Cycle) | Entrance Exam | Why Apply | Brochure Link | Average Placement Salary (LPA) | NIRF Ranking |

| XLRI Jamshedpur | 25,00,000 | Nov 2025 | XAT | Ethics-focused, strong finance placements. | Download Here | 30 | 7 |

| SPJIMR Mumbai | 20,00,000 | Nov 2025 | CAT/GMAT | Innovative pedagogy, finance specializations. | Download Here | 33 | 9 |

| MDI Gurgaon | 24,00,000 | Nov 2025 | CAT | Corporate ties, finance research. | Download Here | 27 | 11 |

| NMIMS Mumbai | 23,00,000 | Oct 2025 | NMAT | Fintech focus, urban location. | Download Here | 24 | 13 |

| IMT Ghaziabad | 19,00,000 | Nov 2025 | CAT/XAT | Dual specializations, placements. | Download Here | 18 | 16 |

| SIBM Pune | 22,00,000 | Nov 2025 | SNAP | Finance operations, campus life. | Download Here | 26 | 17 |

| Great Lakes Chennai | 18,00,000 | Jan 2026 | CAT/XAT | Analytics in finance, ROI high. | Download Here | 18 | 21 |

| ICFAI Hyderabad | 16,00,000 | Dec 2025 | IBSAT | Case-based learning, finance. | Download Here | 12 | 25 |

| IMT Nagpur | 14,00,000 | Nov 2025 | CAT/XAT | Emerging finance trends. | Download Here | 10 | 30 |

| KJ Somaiya Mumbai | 19,00,000 | Jan 2026 | CAT/CMAT | Sustainable finance focus. | Download Here | 15 | 35 |

| Welingkar Mumbai | 13,00,000 | Jan 2026 | CAT/XAT | Design thinking in finance. | Download Here | 12 | 40 |

| Amity Noida | 12,00,000 | Feb 2026 | CAT/MAT | Global finance exposure. | Download Here | 8 | 45 |

MBA Finance Placements

MBA Finance placements have remained consistently strong, especially in institutes located near major financial hubs. Graduates typically step into roles across banking, consulting, corporate finance, fintech and investment firms. Most B-schools run dedicated placement cells that organise recruitment drives, mock interviews, skill-training workshops and summer internships, helping students build confidence before final interviews.

Placement outcomes depend on factors such as specialisation strength, student performance, industry exposure and the overall reputation of the institute. In 2025, top B-schools recorded placement rates of around 80–95%, with average salaries ranging from 10–30 LPA and significantly higher packages for finance-focused campuses in Mumbai, Bangalore and Delhi.

Placements usually begin in the final year with aptitude tests, case rounds and interviews. A noticeable trend in recent years is the rise of fintech hiring, thanks to the growth of digital banking, payments and analytics. This section of the MBA ecosystem highlights job roles, salary growth, industry demand and sector-wise opportunities—showing how finance remains one of the most resilient specialisations.

MBA Finance Job Roles and Salaries

MBA Finance graduates fit into strategic roles that blend financial insight with analytical problem-solving. Entry-level profiles often include analyst positions in banks, consulting firms and corporates. Freshers generally earn between 10–20 LPA, with top-tier graduates landing packages in the 25–35 LPA range. Demand for finance talent keeps compensation competitive, and professionals with 2–5 years of experience can earn 25–50 LPA depending on the complexity of their portfolio.

| Job Role | Average Salary (LPA) | Key Skills Required |

| Financial Analyst | 12-25 | Analysis, modeling, Excel |

| Investment Banker | 20-40 | M&A, valuation, negotiation |

| Finance Manager | 15-30 | Budgeting, reporting, leadership |

| Risk Analyst | 12-25 | Risk assessment, stats |

| Portfolio Manager | 18-35 | Investment strategy, markets |

| Fintech Specialist | 15-28 | Tech, blockchain, payments |

| Corporate Treasurer | 20-35 | Cash management, funding |

| Financial Consultant | 10-22 | Advisory, planning |

2025 data; vary by factors.

MBA Finance Career Growth Projections

Career growth in MBA Finance is strong, with opportunities to rise to senior leadership positions over time. Many professionals reach managerial roles within 3–5 years and move to director-level responsibilities within 6–10 years, depending on performance. Salary increments typically fall in the 15–20% annual range for high performers.

Fintech, ESG finance (environmental, social, governance), and financial analytics are projected to grow 25–35% by 2030, expanding the scope of hybrid roles that combine finance with technology.

| Experience Level | Projected Role | Average Salary Projection (LPA by 2030) |

| 0-2 Years | Analyst | 15-25 |

| 3-5 Years | Senior Analyst/Manager | 30-45 |

| 6-10 Years | Director | 50-70 |

| 10+ Years | CFO | 80+ |

MBA Finance Placement Statistics and Top Recruiters

MBA Finance placement statistics remain impressive across premier institutes. In 2025, leading campuses such as IIM Ahmedabad, Bangalore and Calcutta recorded 85–95% placement rates. Average packages hovered around 25–35 LPA, with the highest offers exceeding 60 LPA, especially in consulting, investment banking and global finance roles.

| Institute | Placement Rate (%) | Average Salary (LPA) | Highest Salary (LPA) |

| IIM Ahmedabad | 95 | 35 | 60 |

| IIM Bangalore | 92 | 34 | 55 |

| IIM Calcutta | 90 | 35 | 58 |

| XLRI | 88 | 30 | 50 |

| SPJIMR | 85 | 33 | 52 |

Top recruiters include global banks, consulting firms and leading corporates: JP Morgan, Goldman Sachs, Deloitte, HDFC, KPMG, McKinsey, BCG, Axis Bank, ICICI and PwC. Analyst and consulting roles dominate, followed by managerial profiles in private banks and corporates.

Opportunities in Different Sectors

MBA Finance graduates find opportunities across a wide range of industries. Banking remains the most prominent sector, offering roles in credit analysis, investment banking and wealth management. Consulting firms recruit heavily for financial advisory and business strategy profiles. Fintech companies hire for product management, digital payments, and financial innovation.

PSUs provide stable finance officer roles, while investment firms offer positions in equity research and portfolio management. Emerging sectors like ESG finance, sustainability analytics and crypto-based services are also expanding.

| Sector | Key Opportunities | Average Salary (LPA) |

| Banking | Credit, Investment Banking | 15-30 |

| Consulting | Financial Advisory | 20-40 |

| Fintech | Product Management | 18-35 |

| Corporate | Treasury, FP&A | 15-28 |

| PSUs | Finance Officer | 12-20 |

| Investment | Portfolio Management | 20-35 |

| Insurance | Risk, Actuarial | 14-25 |

Global Opportunities after MBA Finance

MBA Finance also opens pathways to international careers. Countries such as the USA, UK, Singapore, UAE and Canada offer high-demand roles in investment banking, consulting, risk analytics and global markets. Many Indian graduates pursue overseas jobs or continue studies through MS or PhD programs. Post-study work visas in the UK and Canada make global mobility easier.

Typical salaries for finance professionals abroad range from USD 70,000 to 150,000 depending on location and role. Certifications like CFA significantly expand global employability.

| Country | Key Opportunities | Average Salary (USD) |

| USA | Wall Street, Consulting | 100,000-150,000 |

| UK | City of London, Fintech | 70,000-120,000 |

| Singapore | Asia Finance Hub | 80,000-130,000 |

| UAE | Tax-Free Banking | 90,000-140,000 |

| Canada | Risk Management | 80,000-120,000 |

MBA Finance Scholarships

Scholarships significantly reduce the financial burden of pursuing an MBA in Finance. They are offered by the government, private organisations and management institutes based on merit, performance, income criteria or category. Entrance exam scores play a major role in securing these awards.

Many modern scholarships now support students pursuing fintech, analytics and sustainable finance. Applications typically require academic transcripts, entrance exam scores, income certificates and identity documents. Most deadlines fall between August and December.

| Scholarship Name | Eligibility | Amount (INR) | Application Deadline (2025-26) |

| IDFC FIRST MBA | Income <6L, merit | 2,00,000 | Dec 2025 |

| Aditya Birla | Merit, top colleges | 1,75,000 | Nov 2025 |

| ONGC | SC/ST, merit | 48,000 pa | Oct 2025 |

| Central Sector | Top rank, income <4.5L | 20,000 pm | Dec 2025 |

| Post Matric SC/ST | SC/ST, income limit | Full tuition | Jan 2026 |

| Merit-cum-Means Minorities | Minorities, income <2.5L | 30,000 | Dec 2025 |

| Pragati Girls | Girls, income <8L | 50,000 | Nov 2025 |

| Saksham Disabled | Disabled, income <8L | 50,000 | Nov 2025 |

| Swanath Orphans | Orphans, technical | 50,000 | Nov 2025 |

| GyanDhan | Merit, no GPA | 2,50,000 | Feb 2026 |

| PM Scholarship | Wards ex-servicemen | 3,000 pm | Nov 2025 |

| UGC PG | SC/ST, qualified | 7,800 pm | Dec 2025 |

| National Means | EWS, merit | 12,000 pa | Oct 2025 |

| Ishan Uday NER | NER, income <4.5L | 7,800 pm | Dec 2025 |

| GSK Pharma | Merit science | 1,00,000 | Dec 2025 |

FAQs

What is the eligibility criteria for MBA Finance?

To be eligible for MBA Finance, candidates need a bachelor’s degree in any discipline from a recognized university, with at least 50% aggregate marks (45% for reserved categories). A valid score in entrance exams like CAT or XAT is required, and work experience is preferred for executive programs, though not mandatory for regular admissions.

How can I get admission into MBA Finance programs?

Admission to MBA Finance involves qualifying in exams like CAT, followed by group discussions, interviews, and counseling. Register for the exam, prepare well, and apply to colleges post-results. Shortlisted candidates attend GD/PI rounds. Document verification and fee payment finalize the seat, with some offering direct based on merit.

What is the syllabus for MBA in Finance?

The MBA Finance syllabus covers four semesters, including managerial economics, financial accounting, corporate finance, investment analysis, and risk management. It features electives, projects, and internships. First year focuses on core management, second on finance specials to equip for strategic roles in finance sectors.

Which are the top colleges for MBA Finance in India?

Top government colleges include IIM Ahmedabad, Bangalore, Calcutta, Lucknow, and Kozhikode, renowned for finance excellence and low fees. Private like XLRI, SPJIMR, MDI, NMIMS, and IMT offer innovative programs and strong networks. Admissions via CAT/XAT scores and rankings guide selection.

What are the placement prospects after MBA Finance?

MBA Finance graduates secure roles in banking, consulting, with averages 10-30 LPA, higher in tops. Positions include financial analyst, investment banker. Recruiters like JP Morgan, Goldman Sachs hire via campus, with rates over 85% in premier institutes, emphasizing fintech and analytics.

What is the difference between MBA Finance and M.Com?

MBA Finance emphasizes strategic financial management and business skills, with practical focus and dissertation. M.Com is theory-oriented in accounting and commerce. Both two years, but MBA suits managerial roles, M.Com academic or accounting careers, depending on institution and goals.

Is CAT compulsory for MBA Finance admissions?

CAT is vital for top colleges like IIMs, ensuring merit selection. However, some accept XAT, MAT, or GMAT. Non-CAT can apply to institutions with own tests or direct admissions, but CAT provides access to scholarships and premier opportunities in finance programs.

What specializations are available in MBA Finance?

MBA Finance offers specializations like corporate finance, investment banking, financial markets, risk management, international finance, fintech, behavioral finance, and sustainable finance. Each includes advanced topics, projects, aligning with industry. Selection based on background, goals, with electives for tailoring.

What scholarships are available for MBA Finance students?

Scholarships include IDFC FIRST (2L for low income), Aditya Birla (1.75L merit), ONGC (48k pa SC/ST). Merit-need based via NSP require scores, income proofs. Reduce burdens, apply early through portals for financial support in MBA Finance.